2026 Retirement Contribution Limits: What You Need to Know for IRAs and Workplace Plans

Each year, the IRS updates contribution limits for retirement accounts to account for inflation and changes under federal law. For 2026, these limits affect several types of retirement plans, including 401(k), 403(b), 457 plans, SIMPLE IRAs, and Individual Retirement Accounts (IRAs).

This article provides a factual overview of the new contribution limits, catch-up provisions, and income ranges, helping readers understand how these updates are structured for the 2026 tax year.

401(k), 403(b), and 457 Plan Contribution Limits

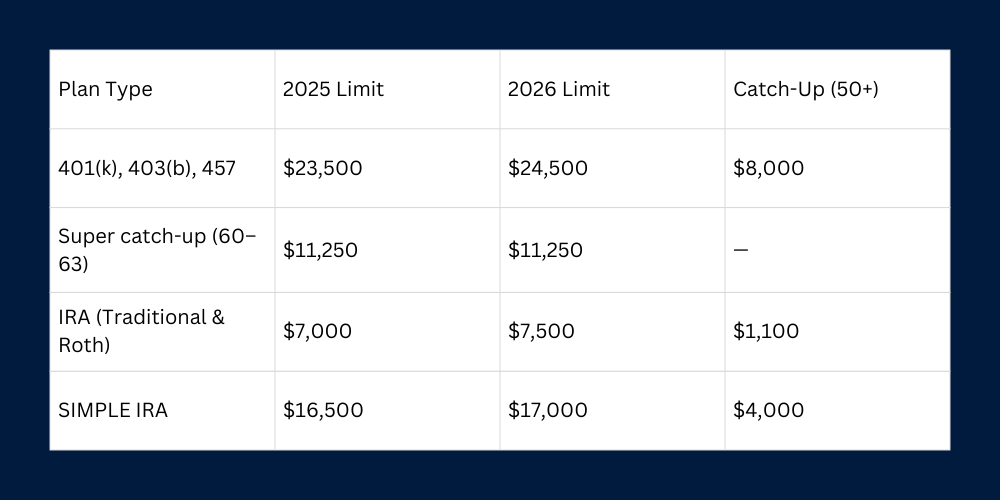

For employees participating in workplace retirement plans such as 401(k), 403(b), or governmental 457 plans, the annual elective deferral limit increases in 2026:

2025: $23,500

2026: $24,500

This represents the maximum amount an employee under age 50 can contribute through payroll deductions.

Catch-Up Contributions

Employees aged 50 and older are allowed to make additional contributions beyond the base limit:

2025 catch-up: $7,500

2026 catch-up: $8,000

Additionally, individuals aged 60 to 63 may contribute a “super catch-up” amount, which remains at $11,250 for 2026. Certain high-income participants may be required to direct catch-up contributions to Roth accounts if their plan allows, in accordance with the SECURE 2.0 Act.

Combined contributions from employees and employers, also called total annual additions, rise to $72,000 in 2026, up from $70,000 in 2025.

IRA Contribution Limits

Individual Retirement Accounts (IRAs), both traditional and Roth, also see an increase in contribution limits:

2025 limit: $7,000

2026 limit: $7,500

IRA Catch-Up Contributions

For individuals aged 50 and above, the catch-up contribution for IRAs rises from $1,000 in 2025 to $1,100 in 2026, bringing the effective total contribution limit for those participants to $8,600.

SIMPLE IRA Contributions

SIMPLE IRAs, often used by small businesses, also have updated limits:

Contribution limit: $17,000 (up from $16,500 in 2025)

Catch-up contribution (50+): $4,000 (up from $3,500 in 2025)

Some plans may allow a slightly higher limit under certain provisions of federal law.

Income Phase-Outs

Income can affect the ability to contribute fully or deduct contributions for certain plans:

Traditional IRA deduction limits for individuals covered by a workplace plan:

Single filers: $81,000–$91,000

Married filing jointly: $129,000–$149,000

Roth IRA contribution limits:

Single filers: $153,000–$168,000

Married filing jointly: $242,000–$252,000

These ranges determine whether contributions are fully allowed, partially reduced, or restricted.

Why Contribution Limits Change

The IRS adjusts retirement plan limits annually to reflect inflation and cost-of-living increases. Changes also incorporate provisions from federal legislation, including the SECURE 2.0 Act, which impacts catch-up contributions and Roth requirements for certain high-income participants.

Summary of 2026 Contribution Limits

These limits apply to the 2026 tax year and reflect federal cost-of-living adjustments and statutory updates.