Washington State Estate Tax 2026: Exemptions, Rates, and Updates You Should Know

Washington State imposes an estate tax, a tax on the transfer of property at death, which differs from an inheritance tax. Recent updates in 2025-2026 adjusted exemptions and tax rates, creating a new framework for estates across Seattle, Kitsap County, and other areas of Washington. This article outlines the current structure of Washington State’s estate tax, including exemptions, rates, deductions, and filing requirements.

What Is the Washington State Estate Tax?

Washington’s estate tax is applied to the estate itself, not to the beneficiaries. It is calculated based on the net value of the estate (after the exemption and allowable deductions), which includes real estate, financial accounts, personal property, business interests, and other assets at the time of death.

Unlike an inheritance tax, where beneficiaries pay taxes, the estate tax is a state-level obligation of the estate before assets are distributed.

Recent Changes Effective 2025–2026

The Washington State Legislature passed legislation in 2025 that updated the estate tax framework:

1. Increased Estate Tax Exemption

The exemption increased from $2.193 million to $3 million for estates of individuals dying on or after July 1, 2025.

Starting January 1, 2026, the exemption will adjust annually for inflation, tied to the Consumer Price Index for the Seattle area.

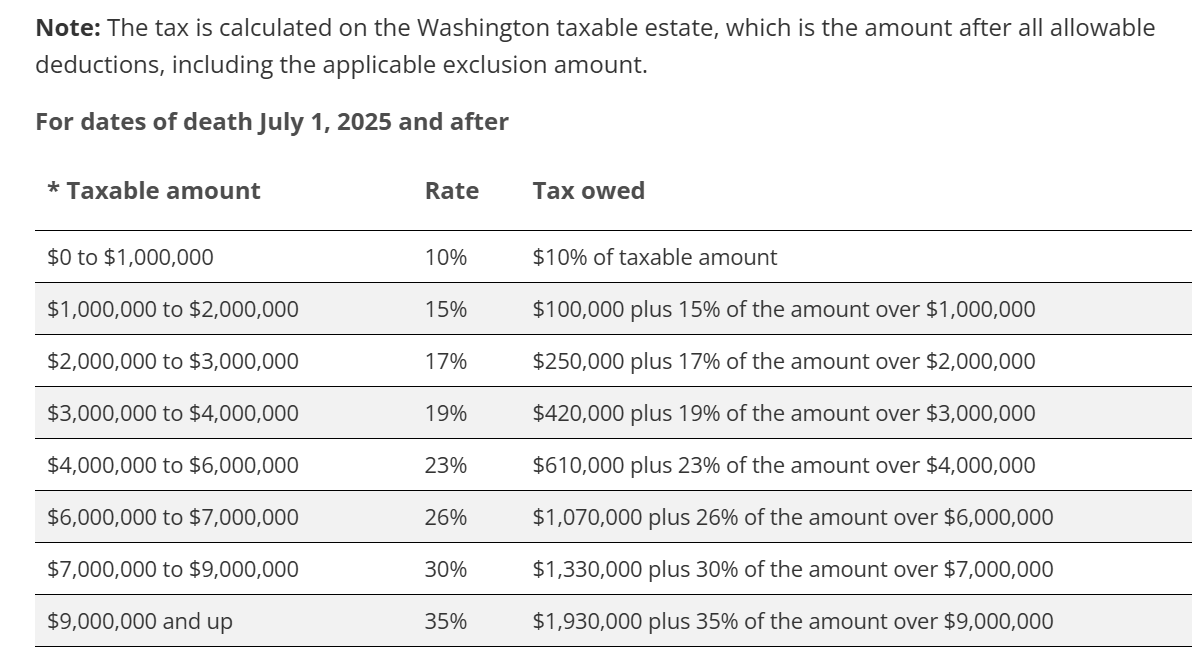

2. Expanded Tax Rates

The estate tax is graduated, with rates ranging from 10% to 35%, depending on the taxable estate value.

Higher brackets have been adjusted to reflect updated thresholds for 2026 and beyond.

3. Deductions Remain Part of the Calculation

Although this list is not exhaustive, common deductions for the estate tax calculation include:

Funeral and administrative expenses

Bequests to a surviving spouse

Charitable donations

Qualified family-owned businesses

Certain farm and personal residence property

Washington Estate Tax Rates 2026 (Overview)

Washington’s estate tax uses a progressive structure:

Filing Requirements

Estates exceeding the exemption amount must file an estate tax return with the Washington State Department of Revenue.

Returns are required even if no tax is ultimately owed after deductions.

Filing deadlines and documentation requirements are detailed on the WA DOR estate tax page. (dor.wa.gov)

The information is provided to you as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites.

Comparison to Federal Estate Tax

The federal estate tax operates independently of Washington’s estate tax.

Federal exemptions and rates change on a separate schedule, and estates in Washington may be subject to both federal and state estate tax calculations.

How Washington Residents Are Seeing This Change

Estates with higher valuations now fall into higher tax brackets.

The annual inflation adjustment.

Residents, attorneys, and estate administrators are reviewing filings and estate valuations in light of these changes.

Key Takeaways

Exemption: $3 million in 2026, indexed to inflation.

Rates: 10%-35% progressive, depending on taxable estate size.

Deductions: Funeral expenses, charitable contributions, spouse, family business, farm, and residence property.

Filing: Required for estates over exemption; returns filed with Washington DOR.

Washington State’s estate tax continues to affect estates of all sizes, particularly in high-cost regions like Seattle, Kitsap, and the Puget Sound area. Staying informed about exemptions, rates, and filing requirements provides a factual overview for residents and estate administrators.

Disclosure: The information contained herein is provided for informational purposes only, should not be relied upon for tax purposes, and is based upon sources believed to be reliable. No guarantee is made to the completeness or accuracy of the information.